James "Jim" Fisk, Jr.

Last revised: May 8, 2023

By: Adam Burns

James Fisk was an American stockbroker and corporate executive who gained fame and wealth through unethical business practices.

Known as one of the "robber barons" of the Gilded Age, Fisk was involved in several high-profile financial schemes, including an attempt to corner the gold market in 1869, which led to a financial crisis known as "Black Friday."

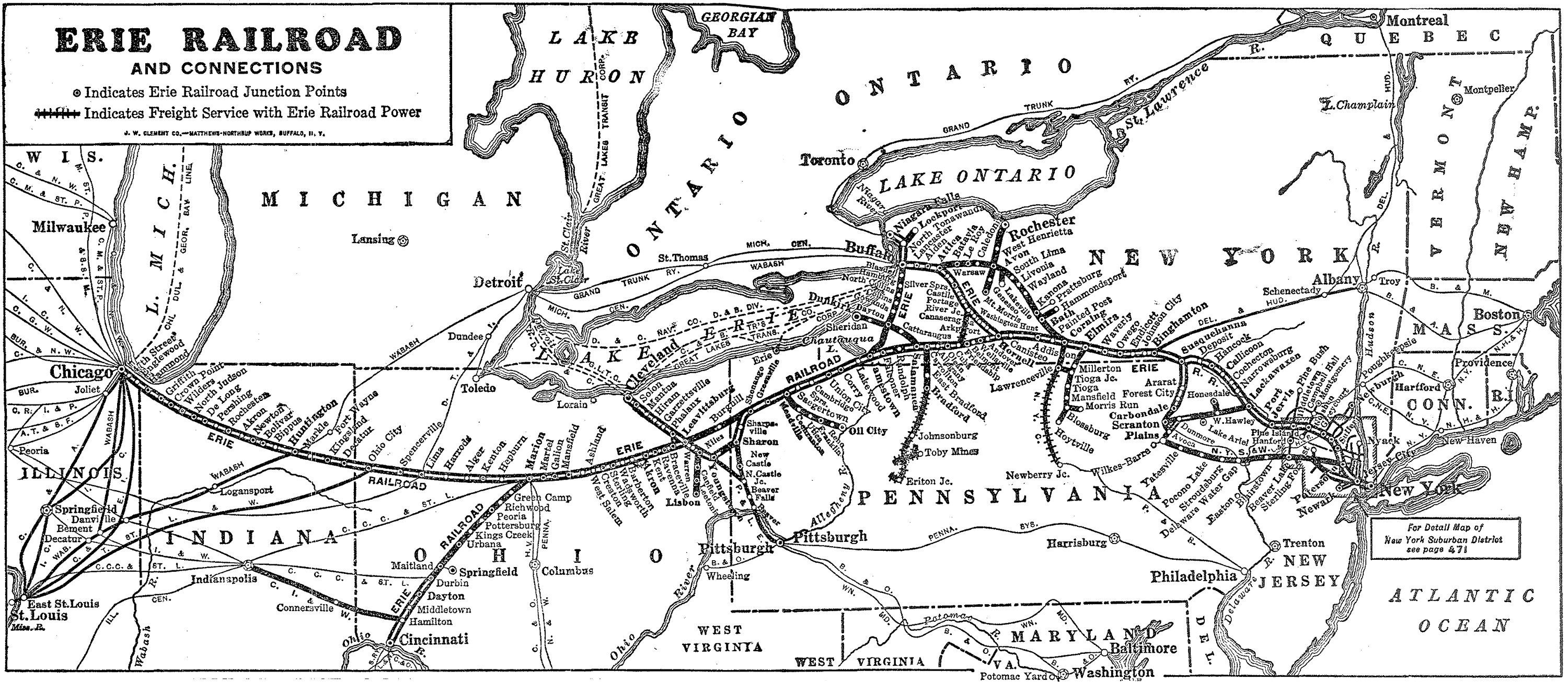

He his arguably best remembered for his efforts, along with Jay Gould and Daniel Drew, in going up against the powerful Cornelius Vanderbilt for control of the Erie Railway. This incident is remembered today as the "Erie War."

His flamboyant lifestyle and controversial business dealings made him a prominent figure in New York society until his murder in 1872. He carried many nicknames including "Big Jim", "Diamond Jim", and "Jubilee Jim."

Background

James Fisk was another example of why 19th century railroad tycoons held such a notorious reputation among the public.

Fisk was particularly egregious. He was ruthless in getting his way, worrying little about taking or losing people's money through various Wall Street dealings in effort to enrichment himself.

However, Fisk's involvement with railroads centered around only one line, the Erie Railway, in which he conspired with Jay Gould and Daniel Drew for control of the company over Cornelius Vanderbilt. Fisk was always Gould's right-hand man and stayed on with the Erie after the fight with Vanderbilt.

Like Gould, Fisk was no railroader. While it could be argued Gould was an effective manager, neither he nor his counterpart were well-versed in the intricacies of railroading. They had both entered the industry solely as speculators and remained in the Wall Street sector throughout their careers.

Fisk held little interest in railroads, concerned only with their monetary possibilities. A classic "robber baron" of the Gilded Age, Fisk would accumulate many enemies, selling out at any turn if he thought it was to his benefit.

These ruthless efforts eventually caught up with him when he was killed at the young age of 37 by a disgruntled business associate. At the time of his death in 1872 his net worth is somewhat murky but is believed to be in the range of $2.45 million.

Early Life

James Fisk, born on April 1, 1835, in a modest home in Bennington, Vermont, embarked on an extraordinary journey that led him to become one of the most formidable figures in America's economic history. His father, a peddler, introduced him to the world of commerce at an early age, shaping Fisk's entrepreneurial spirit.

In his personal life, Fisk married Lucy Moore in 1854. Despite a rocky relationship aggravated by Fisk's numerous affairs, notably with the infamous actress Josie Mansfield, the couple never officially separated.

During the early stages of his career, Fisk ventured into small businesses and showmanship, eventually aligning with Jordan Marsh, Boston's prominent businessman. However, his destiny altered radically when he partnered with Jay Gould and Daniel Drew during the Erie War for control of the Erie Railway.

Like many of the famed railroad tycoons Fisk did not attend school long, only until about the age of 16 when he ran away and joined the circus. After this short career he briefly worked as hotel waiter before returning back to Vermont and taking over his father's peddling business.

Using his experience while out working on his own Fisk was able to make his Dad's business rather successful and was later able to earn a position with a Boston mercantile firm, Jordan Marsh & Company.

At A Glance

James Fisk, Sr. (father) Laura "Love" Ryan (mother) | |

Shrewd Businessman

Fisk's shrewd nature earned him the position of partner with the business. He would also make a name for himself during the Civil War, dealing with government contracts for textiles during the conflict.

However, he also earned a notorious reputation during the war by smuggling Southern cotton through the Union blockade and selling Confederate bonds to European interests.

In 1864 Jim Fisk teamed up with Daniel Drew, whom he worked as a buyer for a few years. In 1866 Drew helped him finance his own brokerage firm, Fisk & Belden and a year later they formed an alliance with Jay Gould in attempt to keep the Erie Railway away from magnate Cornelius Vanderbilt.

They were willing to launch a considerable array of manipulative tactics to maintain control of the railroad, proving formidable adversaries to Vanderbilt's ambitions.

Erie War

What became known as the "Erie War" occurred when Vanderbilt attempted to gain control of the Erie Railroad to include with his NYC&HR system. This would be the only time Jay Gould ever bested Vanderbilt. In what essentially started as an argument between the two turned into a battle of wills as Vanderbilt attempted to corner Erie's stock.

In response, Gould and his associates attempted to artificially inflate the Erie's stock value (also known as "watered stock", Gould was issuing new stock as soon as Vanderbilt purchased it), which is fraud and against the law. However, Gould only defeated Vanderbilt by bribing the New York state legislature, which allowed the stock to be legalized.

Eventually, the war was settled with Vanderbilt (who sued to reclaim his lost money) and Gould stayed in control of the Erie. Realizing that Gould held all of the cards with the railroad, Fisk allied with him and together they betrayed Drew forcing him out of power with the Erie.

Black Friday (Gold Market)

Fisk's and Jay Gould's legacies as shady speculators and businessmen likely began (at least in the public's eye) when, on September 24, 1869, the duo attempted to corner the gold market.

The hope was that by inflating the price of gold the two could likewise raise the price of agricultural products in the western states and lure farmers to sell, allowing for a great deal of freight traffic to begin moving eastward, and presumably over railroads in which they either controlled or held an interest.

Their extensive buying triggered a surge in gold prices, but their scheme ultimately backfired when President Ulysses S. Grant was forced to step in and break up their scheme (although questions have arisen as to whether Grant at least aided in their initial efforts). In doing so, the gold market crashed, leading to severe financial repercussions.

Fisk thrived amidst Wall Street's ruthlessness. His flamboyant lifestyle and unabashed business manipulations caught the public's eye. However, his actions weren't without consequence. His association with corrupt politicians and manipulative business practices resulted in numerous critics and opponents.

Many instances reflected Fisk's dubious dealings. From his involvement in the Erie War to his attempt to corner the gold market, Fisk was no stranger to controversy. Moreover, his run-in with Edward Stiles Stokes eventually led to his demise.

Death

Despite a falling out amongst Fisk and Gould after this incident they continued to work together during Gould's later ploys with the Wabash, Missouri Pacific, and Union Pacific railroads.

In a dramatic turn of events, Fisk was murdered by Edward Stiles Stokes, a former business associate, on January 6, 1872. Stokes, motivated by a complex mix of financial disputes and personal conflicts revolving around Josie Mansfield, shot Fisk in a New York hotel.

Legacy

Fisk's wealth was considerable. However, his net worth remains a subject of historical speculation due to his secretive dealings and manipulation of assets. His estate, reported to be worth millions, was embroiled in litigation following his death.

Despite his controversial character and questionable practices, Fisk's legacy in American business history is significant. His aggressive strategies, albeit ethically questionable, influenced Wall Street dynamics, leading to substantial changes in American corporate governance and law.

In his lifetime, Fisk's flamboyant persona and high-risk financial maneuvers polarized public opinion. His association with the "Robber Barons" of Wall Street and his spectacular fall have inspired numerous works of literature and film.

One must not forget Fisk's involvement in the American theater. His colorful character extended beyond his financial antics. Fisk, a patron of the arts, owned and operated the Grand Opera House in New York City, indulging his love for showmanship.

Fisk's journey was nothing short of dynamic - from a peddler’s son to a Wall Street tycoon. His life offers instructive insights about the American Dream's dual nature – in his relentless pursuit of wealth and power, Fisk embodied both the potential and the perils.

Fisk, with his partners Jay Gould and Daniel Drew, brought about a fundamental transformation in business methodology. While their approach was diabolically cunning, it radically revised the rules of the game on Wall Street.

Fisk's role in the Erie War displayed his shrewdness and strategic acumen. His actions were instrumental in defeating one of the most powerful men of his time, Cornelius Vanderbilt, once again demonstrating his knack for exploiting opportunities regardless of the associated ethical questions.

During the Erie War, Fisk's audacious tactics personified the ruthless nature of corporate struggles of the period. His relentless struggle for power, coupled with his strategic management of financial and political assets, were significant contributors to Jay Gould and his associates' ultimate victory.

Fisk's audacious attempt to corner the gold market during "Black Friday" led to significant financial turmoil, affecting both business magnates and everyday citizens. The event, though disastrous, brought crucial shortcomings to light in economic policies and led to substantial financial reforms.

Unlike many of his contemporaries, Fisk displayed an exceptional flair for public relations. With his showmanship and talent for building public rapport, he captivated the media, becoming a subject of attention and fascination despite his shady financial dealings.

Fisk's murder sent shockwaves through American society. His sudden and violent death was reflective of the turbulent world he inhabited. The sensational nature of his death, arising from a blend of financial disputes and scandalous love triangles, captivated public attention, turning him into a legendary figure.

Following his death, Fisk's notorious reputation continued to influence public perception. While his ingenuity and ambition were often celebrated, his manipulative tactics and involvement in crooked deals left a lasting stain on his legacy.

In retrospective, Fisk’s contribution to the American financial landscape is substantial. His strategies initiated changes in investment methods and corporate control. His actions led to enhanced regulatory scrutiny, changing the dynamics of Wall Street forever.

Fisk's flair for theatrics and the media served him well in his lifetime, creating a public personality larger than life. His dynamic life story continues to intrigue researchers, historians, and students seeking to understand the drama and dynamics of 19th century American finance.

The legacy of Fisk's actions and the resulting public outcry was instrumental in bringing about reform in financial practices. The need for transparency, accountability, and strict regulations was recognized more profoundly in the wake of Fisk's audacious financial maneuvers.

The transformation of Wall Street from the age of James Fisk to contemporary times is particularly noteworthy. While practices like Fisk's are today condemned and legally prosecuted, they were not uncommon during his tenure, reflecting the evolution of American economic values and regulatory norms.

Although Fisk's reputation was marred by dubious dealings and questionable ethics, his impact on Wall Street and American business is beyond dispute. Fisk's story elucidates the complex dynamics of power, wealth, ambition, and ethics in the American corporate world.

In the field of American corporate history, James Fisk is a character who evokes both admiration and ire. His strategies and actions serve as lessons for business school students, financial wizards, and economic historians alike.

Despite his controversial life, Fisk's contribution to shaping the American financial landscape cannot be understated. His tactics and strategies played a significant role in igniting a discussion on business ethics and corporate governance, influencing reforms still relevant today.

Throughout his life, Fisk's relentless pursuit of power and wealth never wavered. His audacious tactics during the Erie War and his infamous attempt to corner the gold market epitomize his unyielding ambition, making his story a riveting narrative of American capitalism in the 19th century.

In conclusion, James Fisk’s life is emblematic of an era defined by unchecked ambition and unregulated financial practices in America. His involvement in several Wall Street controversies, notably the Erie War, left an indelible mark on American economic history.

James Fisk’s life story provides invaluable insights into the intertwining of business and politics in the American financial world. Despite his transgressions, his actions serve as essential case studies in evaluating the development and dynamics of 19th-century American capitalism.

For modern audiences, James Fisk's life serves as a vivid reminder of the complexities of Wall Street practices. His life story is not just of a man’s unrestricted ambition and audacity but also a testament to an era's economic ethos.

Fisk’s life, marked by dramatic highs and lows, is a fascinating narrative of ambition, resilience, and human complexity. His actions and their impacts present a uniquely absorbing study of 19th-century American corporate control contests and Wall Street dynamics.

Even today, the life of James Fisk retains its relevance. It serves as a timely reminder of the roles of corporate morality, ethical decision-making, and legal oversight in shaping economic landscapes. Thus, understanding Fisk and his era is crucial to any comprehensive study of American financial and corporate history.

Contents

SteamLocomotive.com

Wes Barris's SteamLocomotive.com is simply the best web resource on the study of steam locomotives.

It is difficult to truly articulate just how much material can be found at this website.

It is quite staggering and a must visit!